What are Congolese main worries? What do Congolese people expect from government?

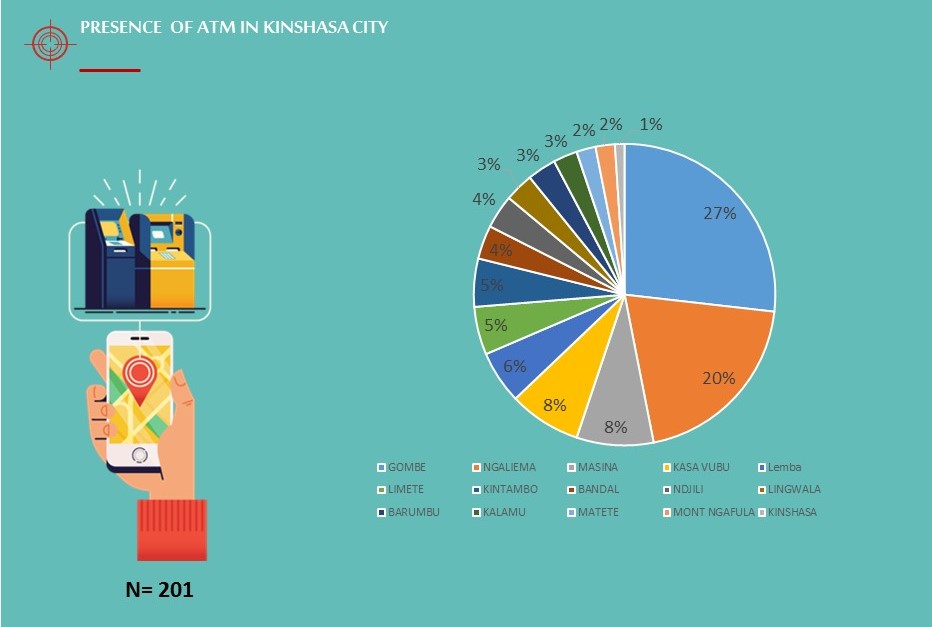

Kinshasa counts 201 ATM in 15 communities over 24, according to Target study

INTRODUCTORY NOTE

Banking sector in DR Congo has been experiencing an increase these recent years with about fifteen commercial banks currently sharing this market against only 5 in 2001. According to Deloitte Study on banking sector in DR Congo (2015 – 2016), almost the totality of banking indicators have been experiencing an increase between 2013 and 2016: The final balance, deposit mobilization, creation of currency by granting credits, development of own funds of sector…With especially putting civil servants in banking services, clients are a little bit many and banks are developing strategies to enlarge their market shares and face up to increasingly tough competition. To get closer to customer and debottleneck some agencies, banks are installing ATM, mostly in junctions, crossroads and most visited points of the city.

Since the very first ATM at Kinshasa, inaugurated on June 26th, 2006 within Procredit Bank (current Equity Bank) premises, this ATM has become a fundamental tool for banks. Studies conducted by us counted 201 active and functional ATM in Kinshasa city up to August 31st, 2018.

METHODOLOGY OF DATA COLLECTION

METHODOLOGY OF DATA COLLECTION

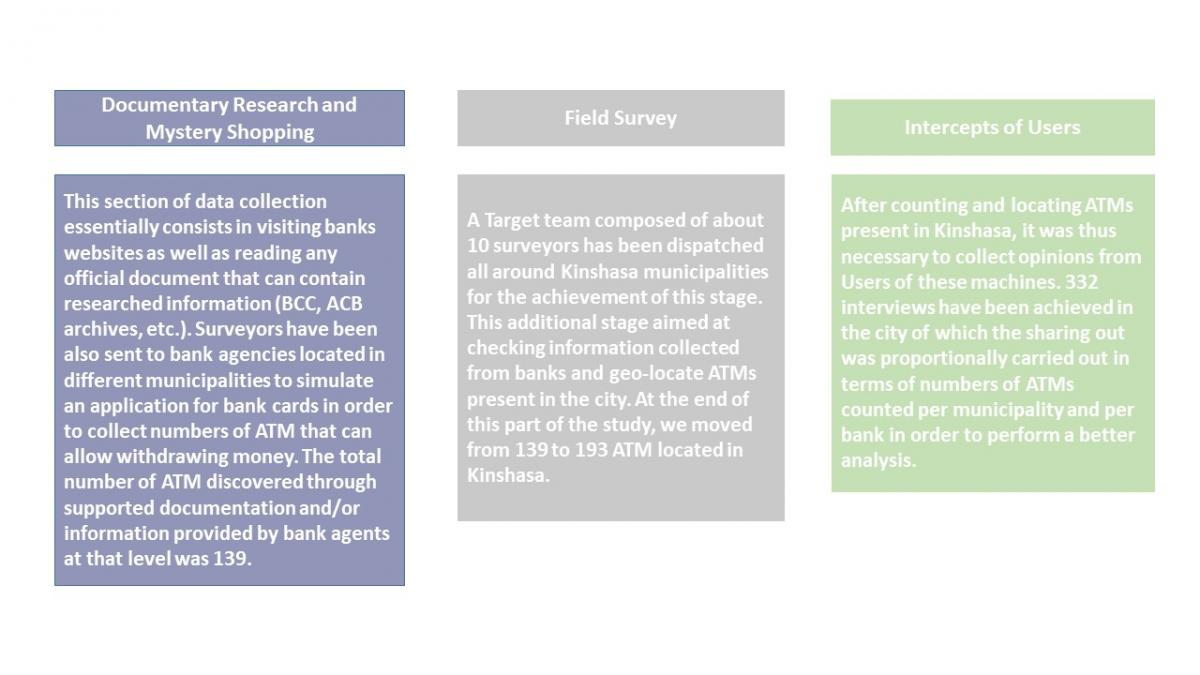

Data collection was performed in August 2018 and combined several techniques: Documentary research, Mystery shopping, field survey and intercepts. The first three were used for counting of ATM and the forth allowed collecting opinions from users of these machines. It is appropriate to indicate that numbers of ATM mentioned in banks’ websites don’t really match with the numbers of ATM found out in the field.

BRIEF DESCRIPTION OF THE STUDY

BRIEF DESCRIPTION OF THE STUDY

Target research firstly introduces the global situation of ATM. This study aims at knowing the number, type and functionalities, sharing out by banks and municipalities as well as geo – location of ATM at Kinshasa.

Then, ATM users gave their opinions on frequency of ATM use, use of other banks’ ATM, sources of information on ATM use, as well as encountered difficulties. They also gave a quotation on quality of services offered by ATM of their bank (presentation of outside aspect, security, cleanliness, cash availability, service availability, withdrawal in USD and CDF, speed of transaction execution, cash deposit in USD and CDF). The study finally addresses main expectations of ATM users.

In order to allow a better understanding of study results, each aspect of the study is presented on a global view (City of Kinshasa), sectorial view (municipalities) and in terms of banks. It is also incorporated a part titled “Appendixes” that summarizes results of each bank in accordance with survey results (total number of ATM at Kinshasa, number of municipalities covered by ATMs, level of users’ satisfaction, evaluation of users on specific criteria such as external aspect, security, cleanliness, cash availability…)

You can have the totality of this publication by calling (+243) 810451052 or sending an email at info@target-sarl.cd

It includes market research, social studies, opinion pools as well as data analysis, design systematic data collection ad interpret inform

Introduction note

Thanks to donors funds ‘supports, as well as macroeconomic political structures careful implemented, Rwanda made consistent growth in reconstructing its econ

The bank field is facing great challenges related to current political and economic situation. This situation does not encourage financial inclusion.