Target’ desk research in Rwanda and Burundi on Banks

After the desk research on banks conducted in DRC, Target research agency conducted 02 other studies on the same theme in Rwanda and Burundi. These studies got inspired directly from the countries background, and offer relevant information for individuals and organisations interested by the bank and financial industry in these countries.

Towards end of 2008, Rwandese bank sector faced liquidity crisis due to drop in banks deposits. This crisis drove banks established in Rwanda think about new strategies to attrack clients. Within this background, the competition became tied between banks, which are striving to implement wining business strategies.

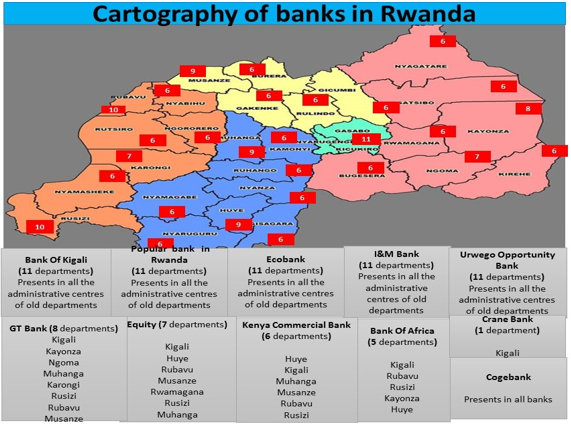

11 banks are present in Rwanda i.e.:

- Bank of Africa

- Bank of Kigali : the most former bank created in 1966

- Banque Populaire du Rwanda : It has the highest social capital (325 000 000 USD).

- Coge banque

- Crane Bank, Ecobank

- Equity

- GT Bank

- I&M Bank

- Kenya Commercial Bank

- Urwego Opportunity Bank.

Most recent banks are GT Bank and Crane Bank which were launched in 2014. Six (06) out of eleven (11) banks have their agencies in all Rwandese regions while Crane Bank has less agencies.

Ecobank has the highest withdrawals fees, i.e. 2% on each withdrawal while Bank of Africa, Bank of Kigali, Banque Populaire du Rwanda, I&M Bank and Urwego Opportunity do not request any fee at withdrawals.

The current research conducted by Target research agency explains the various documents requested when opening a bank account in Rwanda. These documents are similar to those requested in Burundi. However, in Burundi, Ecobank requests residence certificate and Interbank requests to have a guarantor having an account within their bank.

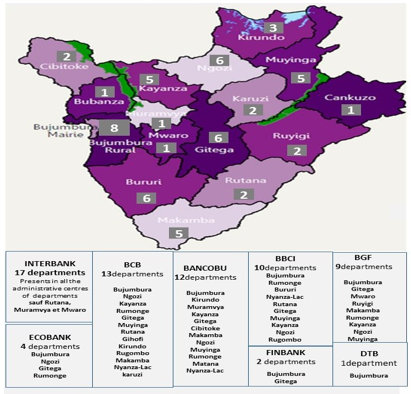

Burundian bank landscape is made of 08 banks:

- Bancobu

- BBCI

- Banque de Crédit de Bujumbura (BCB)

- Diamond Trust Bank (DTB)

- Banque de gestion et de Financement (BGF)

- Ecobank

- Finbank

- Interbank. Present in all main capital cities a part from Rutana, Muramvya and Mwaro.

Cartography of Banks in Burundi

In almost all these banks, the initial deposit for current account is 50 000 FBU a part from Interbank which requests 200 000 FBU and BGF which requests 300 000 FBU as initial deposit. BGF is also the only Burundian bank requesting fees on withdrawal (750 FBU). For saving accounts, Burundian banks usually request 50 000 FBU as initial deposit, but Interbanque requests 1 000 000 FBU and BGF requests 300 000 FBU.

The two studies are conducted by Target research agency have many other relevant information enabling to have a clear and specific idea on banks within these two countries. You can get these by sending an email at info@target-sarl.cd or calling (+243) 81 045 1052.

Target